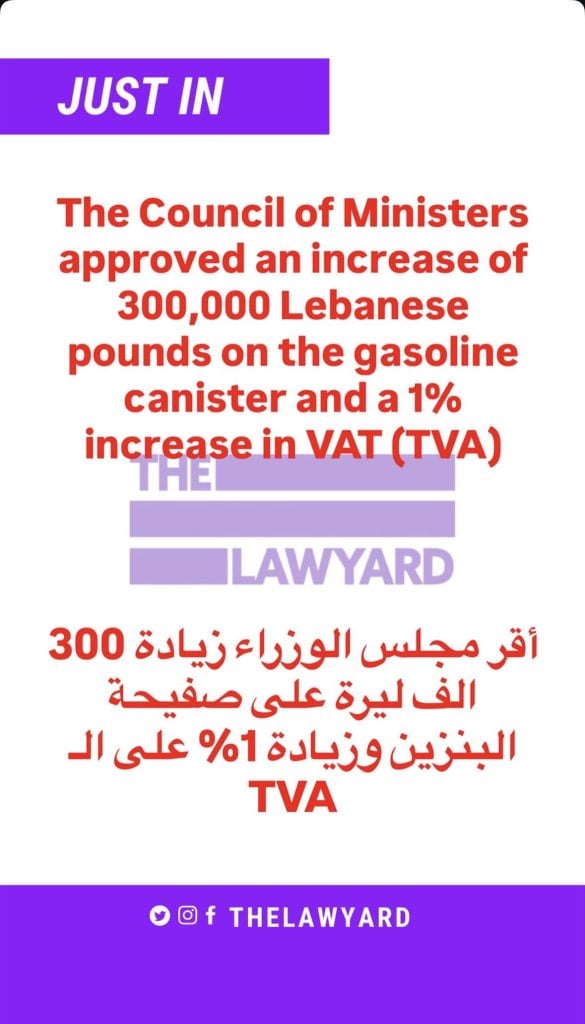

12% VAT & New Fuel Taxes: What the Lebanese Gov’t Just Approved

The Lebanese Council of Ministers has approved a proposal to raise the Value-Added Tax (VAT) from 11% to 12%. This 1-percentage-point increase is part of a fiscal package designed to secure approximately $200 million in annual revenue to finance public sector wage increases.

The government intends to grant six additional monthly salaries to public sector employees and retirees, a move aimed at providing relief from years of economic stagnation. However, this relief comes with a cost to be solely absorbed by, as usual, the average Lebanese citizen who is already crushed by inflation. The incoming changes:

- VAT Hike: Pending final ratification by Parliament.

- Fuel Prices: An immediate increase of 300,000 LL on the price of a 20-liter benzene canister.

- Logistics: New fees on shipping containers ($50–$80) to further bolster the treasury.

via The Lawyard on Instagram

While the Cabinet has given the green light, the VAT increase and the full wage package remain contingent on a final vote in Parliament. Once passed, the new 12% rate will apply to most goods and services nationwide.

For updates, make sure to check out the #News section on our website.